Addressing Common Challenges in Long Term Care Insurance for Peace of Mind. Discover how To tackle common issues in long-term care insurance. Ensure peace of mind for yourself & your loved ones with simple, practical solutions.

What is Addressing Common Challenges in Long Term Care Insurance for Peace of Mind & how does it work?

This concept refers To solutions improving long-term care insurance. Understanding coverage options aids consumers. The core focus remains on managing care costs. Different plans offer varied levels of protection. Clients receive assistance in securing financial stability. Knowledge allows better decision-making regarding care needs.

Brief history of Addressing Common Challenges in Long Term Care Insurance for Peace of Mind

Long-term care insurance evolved throughout years. Initially, coverage options lacked clarity. As demand grew, policy designs improved. Regulations shaped offerings in multiple demographics. Increased public awareness highlighted importance of securing plans. Today, many recognize necessity of coverage for future care needs.

How To implement Addressing Common Challenges in Long Term Care Insurance for Peace of Mind effectively

First, assess personal care needs accurately. Identify potential risks & long-term scenarios. Next, research various coverage options available. Compare premium costs & benefit structures thoroughly. Speaking with qualified agents provides valuable insights. Completing necessary paperwork ensures efficient implementation of chosen plans.

Key benefits of using Addressing Common Challenges in Long Term Care Insurance for Peace of Mind

- Financial security against high health care costs

- Preserves assets for family & heirs

- Offers expanded choices in providers & services

- Enhances quality of care in later years

- Reduces stress for family members & caretakers

Challenges with Addressing Common Challenges in Long Term Care Insurance for Peace of Mind & potential solutions

Many consumers encounter confusion regarding terms. Simplifying language through educational resources helps. Affordability remains a significant barrier for some. Exploring potential discounts or state programs provides relief. Understanding policy limitations assists in better decision-making.

Future of Addressing Common Challenges in Long Term Care Insurance for Peace of Mind

Upcoming trends focus on personalization of coverage. Innovative technology integration will transform assessments. More individuals will actively engage in planning their care. Additionally, policies will likely include hybrid options. A shift toward preventive care will emerge as a collective priority.

Table of Addressing Common Challenges in Long Term Care Insurance for Peace of Mind

| Aspect | Description |

|---|---|

| Coverage Types | Home care, assisted living, nursing facilities |

| Funding Options | Personal savings, policies, government programs |

| Consumer Awareness | Increasing through workshops & seminars |

| Technology | Using online tools for better comparisons |

| Policy Trends | Hybrid policies combining life insurance & care |

Understanding Long Term Care Insurance

Long term care insurance provides essential coverage for individuals requiring assistance due To chronic illnesses, disabilities, or other long-lasting conditions. Many face challenges regarding this crucial coverage. Awareness of these challenges can help mitigate concerns & foster peace of mind. Numerous factors impact decision-making processes surrounding long term care insurance. Evaluating options requires careful consideration of individual circumstances.

One common misconception revolves around costs associated with long term care insurance. Premiums can vary significantly based on age, health, & coverage preference. Resources like Texas Department of Insurance offer valuable information on navigating policies. Understanding potential expenses helps individuals prepare financially. This preparation ensures that families avoid unexpected financial burdens later.

Another challenge often faced involves understanding policy features. Coverage details, benefit limits, & disclaimers are crucial for individuals seeking long term care policies. Individuals may find deciphering language within policies complicated, creating confusion. Researching policy nuances can provide clarity. Seek assistance from licensed agents & professional advisors when necessary.

Evaluating Personal Needs

Identifying personal care needs is essential in determining appropriate insurance coverage. Individuals should assess their current health, lifestyle, & family history. These factors provide insight into potential future needs. Several people overlook this preliminary evaluation, leading To insufficient coverage.

Plans must align with individual requirements. Consider factors such as living arrangements, support networks, & financial goals. Personal preferences play a role; hence, identifying what care services are preferable remains crucial. Seek additional resources, for instance, consult with health care providers or family members.

Expected longevity also impacts planning. With advancements in medical technology, individuals may live longer, thus necessitating long term care services. Evaluating expected life span aids in understanding how long coverage might be necessary. This knowledge provides a more robust framework for decisions regarding insurance policies.

Financial Considerations

Understanding financial obligations associated with long term care insurance proves paramount. Premium costs, copayments, & deductible obligations remain significant factors. Individuals often find premiums challenging, particularly on tight budgets. Exploring various payment options helps ascertain manageable routes for coverage.

Seek detailed information on policy costs by contacting insurers directly. Comprehensive research allows individuals To receive quotes tailored To specific circumstances. Additionally, exploring financial assistance programs available through organizations, such as California Department of Insurance, ensures individuals secure affordable options.

Trying different policies against one another can unveil potential savings. Comparison shopping aids in finding an affordable policy while still meeting coverage needs. Educating oneself on various policy structures ensures people grasp what each option entails, ultimately supporting informed decision-making.

Common Misunderstandings

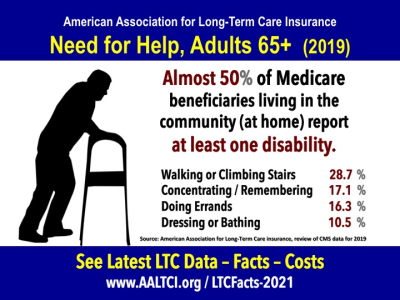

Several misconceptions hinder individuals from effectively navigating long term care insurance. Many believe that Medicare covers long term care services. This perception leads individuals To overlook necessary insurance options. Education plays a vital role in dispelling these misunderstandings. Understanding what Medicare covers, as well as what remains excluded, promotes informed discussions regarding insurance choices.

Another myth involves The idea that policies are unnecessary for younger individuals. Anyone may face unexpected health challenges, regardless of age. Planning for future care needs appropriately allows individuals To secure peace of mind. Starting insurance plans early often results in significantly lower premiums.

People frequently assume long term care policies lack flexibility. Modern policies frequently offer varying levels of benefits, making them adaptable To personal health care requirements. Researching various policies reveals multiple choices available specific To individual circumstances, ensuring personalized care coverage.

The Application Process

Navigating application processes for insurance can become overwhelming. Completing necessary paperwork requires attention & diligence. Many feel unsure regarding where To start when initiating this process. Taking small steps proves effective. Gather personal information & health history, as these documents may play a crucial role.

Working with licensed insurance agents smooths navigation through this complex process. They provide guidance for filling out forms while also ensuring The process remains efficient. Experienced agents offer insight on potential pitfalls, which saves individuals time & money in The long run.

Review all materials provided thoroughly. Individuals should feel comfortable asking questions or seeking clarifications regarding any ambiguity within documents. A clear understanding fosters confidence during The application, ultimately enhancing satisfaction with chosen policies.

Policy Selection

Choosing an appropriate policy requires thoughtful consideration of various factors affecting coverage. Begin by evaluating personal health history, financial situation, & family expectations. These aspects contribute significantly when selecting policies providing adequate support.

Engaging in discussions with loved ones often uncovers valuable perspectives. Family members may provide insights regarding care preferences or concerns centered on logistics surrounding caregiving. Gathering family feedback ensures that chosen policies reflect everyone’s needs, fostering a supportive environment surrounding future care options.

Consulting with financial planners may also enhance understanding of how insurance policies align with overall financial strategies. These professionals help evaluate assets & income. They provide insights on how long term care insurance fits into a larger financial plan, ensuring people maintain financial stability when facing health challenges.

Understanding Types of Coverage

Long term care insurance encompasses a variety of coverage options. Policies may vary in structure, benefits offered, & eligibility requirements. Leading covered services include in-home care, assisted living, & nursing facility care. It becomes essential To understand what coverage encompasses To make informed selections regarding insurance.

Some policies carry monthly premiums while others provide lump-sum payments. Assessing each option allows individuals To determine which plan best aligns with lifestyles & financial resources. Understanding different payment models aids planning for future long term costs, alleviating some worry surrounding financial obligations.

Research also helps individuals understand additional features, like inflation protection or waiver of premium clauses. Inclusive policies often offer such benefits. Comparing these aspects ahead of time supports resilience against unexpected health scenarios that arise.

Regularly Reviewing Policies

Annual evaluations concerning your insurance policy maintain relevance throughout changing life stages. Individuals may discover significant shifts in their health or financial circumstances that warrant policy adjustments. Regular reviews serve as an opportunity for enhanced comfort & security.

Taking time each year To assess policies fosters awareness regarding any potential gaps in coverage. Not every policy remains suitable indefinitely; hence individuals should continuously seek updates on evolving needs. Engaging trusted advisors helps recognize when adjustments prove necessary.

Staying informed about changes in insurance regulations, premiums, or coverage options further supports tedious evaluations. Awareness allows individuals To adapt quickly, securing plans that match personal needs throughout life’s uncertainties.

Retaining Peace of Mind

Securing long term care insurance establishes a foundation for peace of mind. Understanding each aspect of coverage, costs, & options available fosters positive experiences with healthcare planning. Numerous options exist for support, leading individuals toward better awareness of their circumstances & choices.

Engaging family & trusted advisors throughout The insurance journey often proves beneficial. Shared discussions cultivate transparency surrounding personal needs & preferences. Armed with knowledge, families can collaboratively navigate through uncertain times more confidently. In turn, this collaboration provides reassurance for everyone involved.

Personal experiences highlight unique pathways surrounding insurance journeys. Volunteering with seniors who need help navigating insurance options offered profound insights into their concerns. Witnessing their struggles underscored life’s fragility. This experience fostered a deep commitment To ensuring others receive proper long term care planning.

Features of Long Term Care Insurance

- Comprehensive Coverage Options 🏥

- Flexible Payment Plans 💳

- Inflation Protection 📈

- In-Home Care Benefits 🏡

- Respite Care Assistance 👩⚕️

- Policy Customization 🎨

Conclusion on The Journey

Navigating long term care insurance offers a myriad of challenges. However, individuals who proactively address these challenges often find solutions leading towards peace of mind. Through diligent research, thoughtful reflection, & open collaboration with loved ones, security surrounding long term health care needs can be achieved.

What is long term care insurance?

Long term care insurance is a policy designed To cover The costs associated with long-term care services, such as nursing homes, assisted living facilities, or in-home care, that are not typically covered by health insurance or Medicare.

Who should consider purchasing long term care insurance?

Individuals approaching retirement, those with a family history of chronic illness, or anyone who wants To ensure they have coverage for potential long-term care needs should consider purchasing long term care insurance.

When is The best time To buy long term care insurance?

The best time To buy long term care insurance is typically in your 40s or 50s when premiums are generally lower, & you are more likely To qualify for coverage without significant health issues.

What types of services does long term care insurance cover?

Long term care insurance can cover a variety of services, including in-home care, assisted living, adult day care, & nursing home care, depending on The specific policy & its terms.

How much does long term care insurance cost?

The cost of long term care insurance varies based on factors such as age, health, The amount of coverage desired, & The specific benefits included in The policy, with premiums typically ranging from a few hundred To several thousand dollars annually.

Are there any tax benefits related To long term care insurance?

In some cases, long term care insurance premiums may be tax-deductible, & benefits received from The policy may also be tax-free, depending on individual circumstances & tax laws.

What is The difference between policies that cover skilled care & custodial care?

Skilled care refers To medical care provided by licensed professionals, typically in a nursing home setting, while custodial care encompasses assistance with daily living activities, such as bathing & dressing, which may not require medical training.

How do I choose The right long term care insurance policy?

Choosing The right policy involves evaluating your needs, reviewing policy options, considering The financial strength of The insurer, & comparing benefits, exclusions, & costs before making a decision.

What happens if I never need long term care?

If you never need long term care, you may forfeit The premiums paid; however, some policies offer premium return options or provide death benefits To beneficiaries, depending on The terms you select.

How is long term care insurance different from health insurance or Medicare?

Long term care insurance specifically covers services related To long-term care needs, while health insurance & Medicare primarily cover medical expenses, hospital stays, & short-term rehabilitation services.

Can I qualify for long term care insurance if I have pre-existing conditions?

Qualifying for long term care insurance with pre-existing conditions may be more challenging, but many insurers will evaluate your health history & consider your overall risk before issuing a policy.

What is an elimination period in long term care insurance?

An elimination period is The waiting time that must pass after a claim is made before benefits begin To be paid, during which The insured is responsible for paying out-of-pocket costs for care.

Are there alternatives To long term care insurance?

Alternatives To long term care insurance may include self-funding through savings or investments, hybrid policies that combine life insurance with long-term care benefits, or government programs that provide assistance with long-term care needs.

What is The maximum benefit period for long term care insurance policies?

The maximum benefit period for long term care insurance can vary significantly, ranging from a few years To a lifetime, depending on The policy you choose & The coverage options you select.

How does The claims process typically work?

The claims process usually involves filing a claim with The insurance company, providing necessary documentation regarding your care needs, & having a licensed professional evaluate your situation To determine eligibility for benefits.

Understanding Long Term Care Insurance

Long term care insurance provides financial support. This financial aid helps cover long-term care services. These services include assistance with daily activities. Individuals often consider policies for peace of mind. It offers a safety net during uncertain times. Making informed decisions creates better outcomes.

Many people face uncertainties regarding long-term care. Factors include costs & various coverage options. Understanding different insurance plans alleviates concerns. Researching terms helps consumers make educated choices. Knowing exact benefits strengthens patient confidence. Education promotes responsible decisions surrounding health.

In my experience, assessing long-term care needs proved crucial. I evaluated personal situations & future scenarios. This preparation allowed understanding of potential costs. With information, choosing suitable insurance became easier. Balanced assessments helped secure necessary coverage seamlessly.

Identifying Key Challenges

Several common challenges arise within long-term care insurance. Recognizing these can alleviate anxiety. First, rising costs create obstacles for many families. Premiums can increase significantly over time. Many families struggle with affordability as they age.

Another major issue revolves around policy understanding. Consumers often find jargon confusing & overwhelming. Misinterpretation of terms leads To uninformed decisions. Accessing reliable resources becomes fundamental for clarity. Websites like The New York Times provide educational content. These resources help demystify complex insurance language.

Moreover, policy exclusions cause frustration for insured individuals. Certain conditions may not qualify for coverage. Lack of transparency leaves customers feeling vulnerable. To mitigate these challenges, individuals need transparency. Open communication with agents ensures clear expectations.

Exploring Coverage Options

Choosing suitable coverage options requires careful thought. Options range from comprehensive plans To limited policies. Comprehensive plans offer extensive benefits & higher premiums. Limited policies may cover specific conditions only. Evaluating personal needs aids in selecting appropriate plans.

Lifestyle considerations also play a pivotal role. Active individuals may require different coverage than those with health issues. Tailoring policies according To lifestyles serves as key. It enhances value & ensures beneficial protection. Resources such as DFS provide insights into various aspects of coverage.

The timeframe for needing care impacts decision-making. Long-term planning remains essential for securing optimal benefits. Individuals must assess potential healthcare needs well in advance. Such foresight reduces stress during later years.

Strategies for Affordability

Affording long-term care insurance remains crucial for many. Families can explore multiple strategies. First, beginning conversations early reduces financial strain. Individuals should consider purchasing policies in their forties or fifties. Waiting until later years can significantly increase costs.

Second, individuals can leverage benefits offered through employers. Some companies provide insurance options for employees. Exploring workplace benefits represents a smart approach. Options might include group policies at reduced rates.

Lastly, consider government programs & assistance. Programs like Medicaid can help cover costs. Researching eligibility opens doors for financial aid. Families should not hesitate To seek help available.

Another Potential Solution: Hybrid Policies

Many individuals explore hybrid insurance policies for enhanced flexibility. Hybrid plans combine life insurance benefits with long-term coverage. These options allow families peace of mind regarding financial security. If long-term care becomes necessary, benefits transfer seamlessly.

Consumers appreciate hybrid policies due To their versatility. Availability of different plans serves various needs. Understanding advantages presents opportunities for long-lasting coverage.

Evaluating potential hybrid options requires dedicated attention. Researching numerous providers ensures The best choices are made. Consulting with a knowledgeable agent simplifies understanding complex details.

Critical Factors Affecting Premium Rates

Age & Health Status

The age of applicants significantly influences premium rates. Younger individuals often experience lower rates. Health status further complicates this dynamic. Those with pre-existing conditions face higher premiums.

Coverage Amount

Another consideration centers around coverage amount. Higher coverage translates into increased premiums. Individuals need evaluations of personal financial situations. Balancing costs versus coverage ultimately leads To informed decisions.

Location

Your location also impacts insurance rates. Areas with high living costs typically charge more. Understanding local market trends aids in effective planning. Adequate preparations influence long-term financial security.

Comparison of Long Term Care Insurance Options

| 🔍 Option | 💰 Cost | 📋 Coverage | 🕒 Duration | ✅ Flexibility |

|---|---|---|---|---|

| Traditional Policy | Higher | Comprehensive | Lifetime | Low |

| Hybrid Policy | Medium | Flexible | Variable | High |

| Short-term Care | Lower | Limited | Up To 12 months | Medium |

Resources for Navigating Your Options

Many resources help navigate long-term care decisions. Websites provide information on specific policies. Tools like comparison calculators simplify evaluations. Various guides offer additional assistance around navigating insurance markets.

Local agencies often support individuals seeking information. Utilizing these local resources helps clarify options. Connecting with community groups increases awareness about available support.

Professional consultants can also play vital roles. Many specialize in long-term care insurance. Their expertise helps individuals choose wisely. Engaging with specialists increases confidence during decision-making.

Planning for Future Needs

Planning for potential long-term care needs remains essential. Approaching this planning takes foresight & dedication. Individuals need To assess their situations thoroughly. Identifying risks creates pathways for addressing them effectively.

Another important aspect pertains To family discussions. Open conversations enable transparency about decisions. These discussions allow individuals & families a voice in planning. Such collaborations foster stronger support systems.

Moreover, regularly reviewing plans ensures continued relevance. Personal circumstances may change over time. Adjustments can facilitate better alignment with needs. Periodic reassessments make care plans efficient & effective.

Long Term Care Insurance for Peace of Mind

Long-term care insurance helps protect against future uncertainties. Although challenges exist within The system, proactive approaches yield benefits. Awareness & information empower individuals. Resources like Carnuna assist in this journey, creating peace of mind.

Conclusion

In conclusion, tackling The common challenges of long-term care insurance can lead To greater peace of mind for you & your loved ones. By understanding what To expect, asking questions, & exploring your options, you can make informed decisions that suit your needs. Remember, it’s all about planning ahead To ensure you receive The care you deserve without financial stress. So, take The time To research, consult with professionals, & get The coverage that gives you confidence about The future. With The right approach, you can face long-term care with assurance, knowing you’re prepared for whatever comes next.