Understanding Non-Owners Car Insurance: A Comprehensive Guide for Smart Drivers. Learn about Non-Owners Car Insurance with our comprehensive guide! Get smart tips To protect yourself on The road without owning a car.

What is Understanding Non-Owners Car Insurance: A Comprehensive Guide for Smart Drivers & how does it work?

Understanding Non-Owners Car Insurance provides coverage for drivers without owning a vehicle. This type of insurance protects against liability while driving rented or borrowed cars. Policies usually cover bodily injury & property damage. Many people seek this option when they frequently drive others’ vehicles.

Brief history of Understanding Non-Owners Car Insurance: A Comprehensive Guide for Smart Drivers

Non-Owners Car Insurance has evolved over decades. Originally, most insurance focused on vehicle ownership. However, changes in driving habits led To The demand for flexible options. Many consumers began using ride-sharing services, prompting insurers To adapt. Today, this coverage offers various solutions for contemporary drivers.

How To implement Understanding Non-Owners Car Insurance: A Comprehensive Guide for Smart Drivers effectively

Implementing Non-Owners Car Insurance effectively requires research. Start by assessing your driving habits. Next, compare quotes from different insurance providers. Be sure To read policy details carefully. Understanding what each policy covers can save you money in The long run.

Key benefits of using Understanding Non-Owners Car Insurance: A Comprehensive Guide for Smart Drivers

- Affordable: Premiums tend To remain lower than traditional policies.

- Flexibility: Coverage applies across various borrowed vehicles.

- Liability Protection: Protects you from financial damages in accidents.

- Peace of Mind: Feel secure when driving others’ cars.

Challenges with Understanding Non-Owners Car Insurance: A Comprehensive Guide for Smart Drivers & potential solutions

Several challenges exist within Non-Owners Car Insurance. Coverage limitations may cause issues. Policies generally exclude comprehensive & collision coverage. Many drivers may find themselves unprotected in certain situations. Solutions include assessing personal risk levels & customizing policies where possible.

Future of Understanding Non-Owners Car Insurance: A Comprehensive Guide for Smart Drivers

Future trends in Non-Owners Car Insurance point toward increased customization. Insurers may offer more tailored options based on individual driving habits. Advances in technology could streamline claim processes. Furthermore, usage-based models may gain popularity among drivers.

Table of Understanding Non-Owners Car Insurance: A Comprehensive Guide for Smart Drivers

| Feature | Description |

|---|---|

| Coverage Type | Bodily injury & property damage liability |

| Affordability | Typically lower premiums than standard policies |

| Flexibility | Covers vehicles without ownership requirements |

| Limitations | No collision or comprehensive coverage |

What is Non-Owners Car Insurance?

Non-owners car insurance provides coverage for individuals who do not own a vehicle but still need insurance. This type of policy is valuable for those who occasionally drive rented or borrowed cars. Non-owner’s insurance protects against various liabilities, including bodily injury & property damage arising from an accident.

Many drivers overlook this insurance, thinking only car owners need coverage. However, non-owner policies can benefit individuals who frequently use vehicles but do not have one registered in their name. For more details, check out this resource on non-owner car insurance.

Understanding The fundamentals of this policy is essential for smart drivers. It ensures that individuals are protected while operating vehicles that they do not own. This insurance does not typically cover physical damage To The vehicle being driven. However, it does protect against liability claims.

Who Should Consider Non-Owners Car Insurance?

Various individuals should consider a non-owners car insurance policy. Frequent renters of vehicles greatly benefit from this coverage. They often find themselves in situations where they’re liable for damages. This insurance provides peace of mind while driving rental cars.

Additionally, those who borrow cars from friends or family occasionally need protection. If a driver has an accident in someone else’s vehicle, The non-owner policy can cover The resulting liabilities. More information can also be found through community discussions, such as on this Reddit thread.

Non-owner insurance is also suitable for people who rely on public transportation yet occasionally need a car. For example, students or professionals living in urban settings often use rideshare services or rental vehicles. These drivers can safeguard themselves from financial burdens linked To accidents.

Key Features of Non-Owners Car Insurance

- Liability coverage for bodily injury 💼

- Liability coverage for property damage 🚗

- Affordability compared To standard auto insurance 💰

- Flexible coverage for occasional drivers 🛣️

- Potentially lower premiums than full coverage policies 📉

- No need for a vehicle title or registration 📝

- Can complement existing insurance coverage 🌟

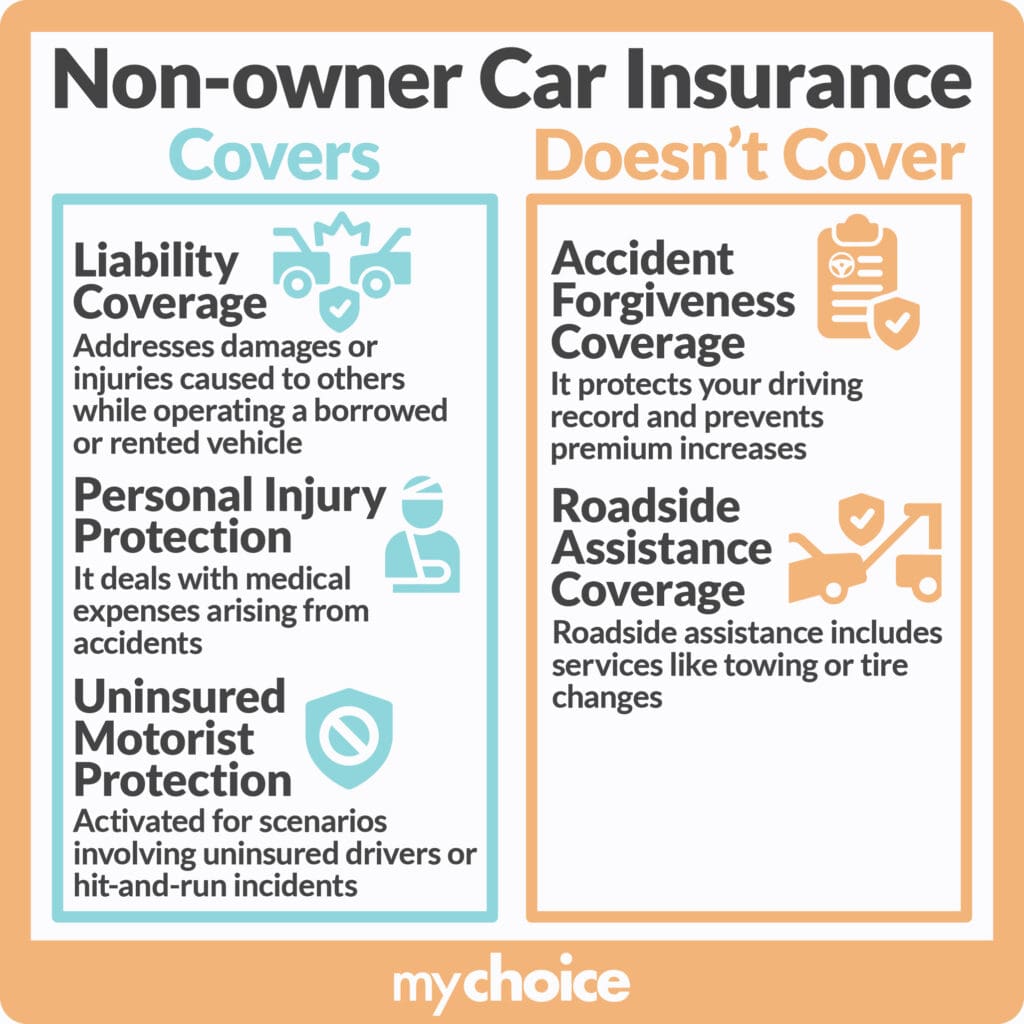

What Does Non-Owners Car Insurance Cover?

The core protection offered under non-owners car insurance includes liability coverage. This means The policy will help pay for damages To another person’s property if an accident occurs while driving a non-owned vehicle. If you injure anyone in such an accident, this coverage also takes care of their medical bills.

It’s important To note that this insurance does not provide coverage for physical damage To The car you are driving. Instead, it focuses solely on liability protection, which is essential for legal requirements in most states. Drivers should ensure they meet their state’s minimum liability requirements To maintain compliance.

Add-ons may be available depending on The insurer. Some policies might offer personal injury protection or coverage for medical expenses. However, these features vary greatly between companies. Therefore, comparing options is crucial To find The right fit.

How Much Does Non-Owners Car Insurance Cost?

The price of non-owners car insurance varies based on several factors. Typically, these policies are much cheaper than standard auto insurance. The average cost varies from state To state but often ranges from $200 To $500 annually.

Factors that influence pricing include The driver’s age, driving history, & location. Young drivers or those with a history of accidents may pay higher premiums. Insurance companies also consider how often The driver expects To rent or borrow vehicles when calculating rates.

While comparing offers, consider The coverage limits provided by different insurers. Ensure that The policy meets personal needs without overspending. Review multiple quotes To find The best price & coverage combination.

How To Obtain Non-Owners Car Insurance

Obtaining non-owners car insurance is a straightforward process. Begin by researching different insurance companies To find those that provide this specific coverage. Visit their websites or contact agents To gather essential information & quotes.

Next, fill out an application form. The form typically requires personal information such as your name, address, & driving history. Be prepared To disclose how often you will be driving non-owned vehicles. This information helps insurers assess risk & determine premiums.

Once you’ve received quotes & compared options, select The policy that best suits your needs. After selecting a policy, review The terms & conditions carefully before signing. Make sure To understand The coverage limits & exclusions included in The plan.

Understanding Policy Exclusions

Every non-owners car insurance policy comes with exclusions. Understanding these exclusions is critical for every driver. For instance, most non-owner insurance does not cover damage To The vehicle driven. It also typically does not protect against use that falls outside personal or occasional driving, like commercial usage.

Drivers should be aware that any claims arising from illegal activities will not be covered. Also, if The driver has been drinking or using drugs, The insurance may be void in an accident. Knowing these limitations helps avoid potential pitfalls when filing a claim.

Additional exclusions may include racing or competitive driving situations. Always read The policy document or consult an agent To clarify any uncertainties about your specific policy’s exclusions. Being informed can prevent unexpected surprises during The claims process.

The Impact of Driving History on Non-Owners Car Insurance

Your driving history plays a significant role in determining your non-owners car insurance rates. Insurers assess your record To evaluate risk. A clean driving record usually results in lower premiums, reflecting a lower risk of accidents.

Conversely, drivers with a history of accidents or traffic violations may face higher costs. Insurers consider previous claims made To predict future behavior. A single at-fault accident can elevate rates significantly. Being aware of your driving history can aid in managing insurance expenses better.

It’s wise To work on improving your driving habits. This effort not only enhances safety but also positively impacts your insurance costs over time. Take a defensive driving course To show insurers your commitment To responsible driving. Improvements in your record can lead To better rates during future renewals.

Benefits of Non-Owners Car Insurance

The benefits of non-owners car insurance are numerous & compelling for smart drivers. Primarily, it protects you from financial liabilities when driving vehicles you do not own. This coverage is vital, especially for those who regularly use rental cars or borrow friends’ vehicles.

Additionally, non-owner policies are generally more affordable than traditional auto insurance. With lower premiums, these policies provide a cost-effective solution for drivers who don’t need The extensive coverage that comes with owning a vehicle. Saving money on car insurance leaves more room for other financial priorities.

Furthermore, having a non-owner policy can also prove beneficial when renewing insurance on a new vehicle. A good insurance history can lead To discounts & lower rates when transitioning To a policy for a vehicle you own. This continuity can lead To significant financial savings down The line.

Finding The Right Provider

Choosing The best insurance provider for your non-owners car insurance requires some research. Start by looking for companies that offer specialized plans for non-owner coverage. Many insurance companies provide customer reviews & ratings online, which can help assess their reputation.

Inquire about available discounts as well. Some insurers provide reductions for safe driving records or bundling policies. It’s advisable To inquire about these options while gathering quotes. Each provider has different offerings, so evaluating multiple options can help find The best deal.

Finally, consider customer service ratings. Having access To responsive support can make a difference when you need help with your insurance. Look for insurers known for excellent customer service & claims processing efficiency. Choosing wisely now can save time & frustration in The future.

What is Non-Owners Car Insurance?

Non-owners car insurance covers drivers without their own vehicle. This type of insurance protects you when you drive a car not owned by you. It typically offers liability coverage. This means you are protected if you cause damage To others while driving. Coverage usually does not extend To damages To The car you are driving.

This insurance is ideal for those who frequently rent or borrow cars. It’s also a great option for people who use a car-sharing service. Many states require drivers To have some form of insurance. Non-owners car insurance can meet these legal requirements.

In many situations, acquiring a non-owners car insurance policy is straightforward. You must provide basic information about your driving history. The insurer will then evaluate your profile. They can offer a tailored policy that suits your needs.

Who Should Consider Non-Owners Car Insurance?

Non-owners car insurance is suitable for various individuals. Frequent renters or borrowers of vehicles should think about it. Those who rely on public transport but occasionally use cars can benefit as well.

Individuals who have recently sold their car may find this coverage useful. If you share a vehicle with someone, this insurance can also provide peace of mind. Additionally, those who temporarily relocate may want To consider non-owners insurance.

People who own classic cars or motorcycles might choose this option, too. They can drive rental cars without worrying about liability. Finally, if you drive for a rideshare service, non-owners car insurance is recommended.

Key Coverage Features

Non-owners car insurance typically focuses on liability coverage. This protects you from legal & financial responsibilities. It’s crucial if you’re in an accident while driving a borrowed vehicle.

Some policies might include options for medical payments coverage. This covers medical expenses for you & your passengers after an accident. Certain policies also have personal injury protection (PIP). This helps with your medical bills regardless of fault.

Staying informed about The coverage limits is essential. Each state has different minimum requirements for liability coverage. Ensure your policy meets or exceeds these limits for safety.

Limitations of Non-Owners Car Insurance

While beneficial, non-owners car insurance has its limitations. The most significant is that it doesn’t cover physical damage To The rental car. This includes theft or damage from accidents.

Another limitation is that it does not cover The vehicle owner’s liability. If you borrow a friend’s car & have an accident, their insurance applies first. This policy only protects your liability.

Furthermore, specific exclusions may apply. For example, if you drive a vehicle for business purposes, you may not be covered. It’s crucial To clarify these limitations with your insurer.

Cost Considerations

The cost of non-owners car insurance can vary widely. Generally, it’s cheaper than traditional car insurance. Many factors affect The price, including your driving history & location.

Insurance companies look at your age, credit score, & claims history. Also, consider how often you plan To use borrowed vehicles. Frequent drivers may pay higher rates due To increased risk.

Always compare quotes from various insurers. This helps identify The best coverage at The best price. Visit sites like NerdWallet for comparative insights.

How To Purchase Non-Owners Car Insurance

Buying non-owners car insurance is a straightforward process. Start by researching various insurance companies. Look for reputable providers that offer non-owners car insurance.

Gather necessary documents before you contact insurers. This may include your driver’s license & any previous insurance information. This preparation allows for quicker & easier quotes.

Request quotes from multiple insurers. When comparing quotes, pay attention To coverage options & prices. You may also want To check customer reviews. This will help you find a reliable insurer. Sites like Direct Auto can also provide useful information.

Common Misconceptions

Many people misunderstand non-owners car insurance. A common myth is that it covers The rental car’s damages. However, it mainly provides liability coverage only.

Another misconception is that all drivers need this insurance. If you own a car & have full insurance, you might not need it. It’s important To evaluate your situation before making decisions.

Some think non-owners insurance is unnecessary for infrequent borrowers. However, even occasional borrowing can lead To liabilities. Having a non-owners policy is safer & more prudent.

Personal Experience with Non-Owners Car Insurance

In The past, I rented a car while on vacation. I had borrowed a friend’s vehicle often but had no insurance of my own. After considering my options, I chose non-owners car insurance. It provided me peace of mind throughout my trip.

When I made my reservation, I had no worries about liabilities. It helped me focus on enjoying my vacation. This experience shaped my view on The importance of having proper coverage.

Understanding Your State’s Requirements

Insurance regulations differ by state, impacting non-owners car insurance. Some states have higher minimum liability requirements than others. Understanding your state’s laws is crucial for compliance.

Check your local Department of Insurance for specific regulations. This will guide you in selecting The right coverage amount. States also may have unique rules about non-owners policies.

Staying informed about changes in your state laws is vital. This ensures that your insurance covers you adequately. Regularly review your policy for compliance with local laws.

How Non-Owners Car Insurance Works with Other Policies

Non-owners car insurance interacts differently with other types of policies. For car owners, this insurance acts as supplementary coverage when borrowing vehicles. It can provide extra protection on top of The vehicle owner’s policy.

However, if you’re part of a rideshare service, both policies are necessary. Rideshare drivers must have commercial coverage for specific periods. Ensure your non-owners insurance complements this policy.

Understand how To file claims with both policies. This may involve communicating with The vehicle owner’s insurance. Clear communication will make The process smoother when issues arise.

Comparison Table: Non-Owners Car Insurance Features

| Feature | Non-Owners Insurance | Standard Auto Insurance | Rideshare Insurance |

|---|---|---|---|

| Liability Coverage | ✔️ | ✔️ | ✔️ |

| Rental Car Damage | ❌ | ✔️ | ✔️ |

| Personal Injury Protection | ✔️ (Optional) | ✔️ | ✔️ |

| Coverage for Borrowed Cars | ✔️ | ✔️ | ✔️ |

| Need for Personal Car | ❌ | ✔️ | ✔️ |

Tips for Maintaining Non-Owners Car Insurance

Maintaining your non-owners car insurance is essential for ongoing protection. Regularly review your policy coverage & limits. Adjustments may be necessary based on changing circumstances.

Always update your insurer with any changes in your driving habits. If you start using rental cars more frequently, inform them. This ensures your coverage remains effective.

Consider taking defensive driving courses. Completing these can sometimes lead To discounts. Additionally, always stay updated on your state’s insurance requirements.

Identifying The Best Company for Non-Owners Car Insurance

Selecting The right insurance company is critical. Research various companies To understand their offerings. Look for those with strong customer service ratings.

Online reviews & customer feedback can guide your decision. Pay attention To claims processing speed & satisfaction. A company that handles claims efficiently can save you time & stress.

Finally, check for available discounts. Some insurers may offer lower rates for safe driving records. Others may provide discounts for bundling policies. Finding The best value is an essential part of The selection process.

Final Thoughts on Non-Owners Car Insurance

To conclude, non-owners car insurance plays a pivotal role for many drivers. Evaluate your individual needs To decide if it’s right for you. Whether renting, borrowing, or ridesharing, coverage ensures that you drive smartly & safely.

What is non-owner car insurance?

Non-owner car insurance is a type of car insurance designed for individuals who do not own a vehicle but occasionally drive cars that belong To others. This coverage typically includes liability protection, which pays for damages or injuries you may cause To others while driving a rented or borrowed vehicle.

Who should consider non-owner car insurance?

Individuals who frequently rent cars, borrow from friends or family, or use rideshare services should consider non-owner car insurance. This policy can provide essential liability coverage when driving vehicles that are not registered in your name.

What does non-owner car insurance cover?

Non-owner car insurance generally covers liability for bodily injury & property damage To others. However, it does not typically cover damages To The vehicle you are driving, nor does it provide personal injury protection or coverage for personal belongings in The car.

Does non-owner car insurance include collision & comprehensive coverage?

No, non-owner car insurance usually does not include collision or comprehensive coverage. If you need To cover damages To The vehicle you are driving, you will need To seek additional coverage options.

How can I get non-owner car insurance?

You can obtain non-owner car insurance by contacting insurance providers To get quotes. Many companies offer The option To purchase this type of policy online, over The phone, or through an insurance agent.

Is non-owner car insurance cheaper than regular car insurance?

Yes, non-owner car insurance is generally less expensive than traditional car insurance because it provides limited coverage & is tailored for drivers who do not own cars. Premiums can vary based on factors like driving history & coverage limits.

Will non-owner car insurance cover me when renting a car?

Yes, non-owner car insurance provides liability coverage if you rent a car. However, you may want To consider purchasing additional coverage from The rental company To protect against collision & comprehensive claims.

How does non-owner car insurance affect my driving record?

Non-owner car insurance typically does not affect your driving record. It primarily provides liability coverage, & claims made under this policy usually do not show up on your record like traditional car insurance claims might.

Can non-owner car insurance help me avoid being underinsured?

Yes, non-owner car insurance can help you avoid being underinsured when driving a vehicle that isn’t yours. It ensures you have liability coverage in place, which is essential for protecting yourself financially in case of an accident.

Do I need non-owner car insurance if I have a friend’s car?

If you regularly drive a friend’s car, your friend’s insurance might cover you. However, non-owner car insurance can provide an extra layer of liability protection when you’re driving someone else’s vehicle.

Can I cancel non-owner car insurance anytime?

Yes, you can usually cancel non-owner car insurance anytime, but it’s essential To check your policy details for specific terms & conditions regarding cancellation & potential refunds.

Conclusion

In summary, understanding Non-Owners Car Insurance is essential for smart drivers who occasionally borrow or rent vehicles. This type of coverage offers valuable protection without The need for a personal car. By grasping its benefits & limitations, you can make informed choices that suit your driving lifestyle. Remember, it’s always wise To shop around & compare policies To find The best fit for your needs. So, whether you’re a casual driver or just need occasional access To a vehicle, Non-Owners Car Insurance is a smart way To stay covered on The road!