Understanding Non-Owner Car Insurance: A Comprehensive Guide for Safe Driving. Looking To drive safely without owning a car? Our guide on Non-Owner Car Insurance explains everything you need for secure driving. Read more!

What is Understanding Non-Owner Car Insurance: A Comprehensive Guide for Safe Driving & how does it work?

Non-owner car insurance provides coverage for individuals without personal vehicles. This type of policy protects against liabilities while driving borrowed or rented cars. Coverage often includes bodily injury, property damage, & legal expenses. Essential features make driving safer & financially secure.

Brief history of Understanding Non-Owner Car Insurance: A Comprehensive Guide for Safe Driving

Non-owner car insurance evolved alongside car rental practices. Originally designed for drivers who occasionally used vehicles, this coverage became essential. As urban living increased, many individuals required flexible options. Over time, companies recognized a demand for customized policies tailored for occasional drivers.

How To implement Understanding Non-Owner Car Insurance: A Comprehensive Guide for Safe Driving effectively

Implementing non-owner car insurance starts with evaluating needs. Research reputable insurance providers. Compare quotes & coverage options. Seek policies that offer comprehensive benefits. Verify limitations & exclusions before signing any agreement. Ensure adequate coverage for your specific circumstances.

Key benefits of using Understanding Non-Owner Car Insurance: A Comprehensive Guide for Safe Driving

- Affordability: Typically lower premiums than traditional car insurance.

- Flexibility: Coverage applies across various vehicles.

- Peace of mind: Protection from expenses related To accidents.

- Legal requirements: Meets minimum liability coverage in most states.

Challenges with Understanding Non-Owner Car Insurance: A Comprehensive Guide for Safe Driving & potential solutions

Challenges include limited coverage options. Many policies exclude certain vehicles, which might create gaps in protection. Some providers may impose strict requirements for eligibility. Consumers should carefully read policy details. Seeking guidance from a licensed agent can help navigate complexities.

Future of Understanding Non-Owner Car Insurance: A Comprehensive Guide for Safe Driving

Future trends suggest increased demand for non-owner car insurance. Growth may stem from rises in shared mobility services. Consumers might prioritize options that accommodate changing transportation habits. Insurers will likely innovate with personalized policies using advanced technology.

Table of Understanding Non-Owner Car Insurance: A Comprehensive Guide for Safe Driving

| Aspect | Description |

|---|---|

| Coverage Type | Liability, bodily injury, property damage |

| Eligibility | Individuals without personal vehicles |

| Cost | Generally lower than traditional insurance |

| Flexibility | Covers various borrowed or rented vehicles |

Understanding Non-Owner Car Insurance

Non-owner car insurance provides essential protection for individuals who drive cars they do not own. This type of insurance is especially valuable for those who frequently rent vehicles or borrow from friends & family. Understanding its coverage can help you avoid potential financial risks associated with car accidents. Moreover, it can be a flexible solution for those who may not drive regularly but still require auto coverage.

Many drivers wonder where To buy non-owner car insurance. Resources like NerdWallet offer comprehensive insights on providers & policy features. Securing a non-owner policy can ensure that drivers remain protected while they are behind The wheel. These plans can also help improve driving records, leading To lower premiums in The long term.

Who Needs Non-Owner Car Insurance?

Individuals who do not own a car but drive occasionally can greatly benefit from this insurance. If you rely on car rentals or borrowed cars, consider non-owner coverage. This insurance also assists those who have lost their vehicles temporarily or are in transition between car purchases. College students are another group that may find this coverage advantageous, especially if they do not have permanent access To a vehicle.

Moreover, rideshare or delivery drivers may consider non-owner policies. They often use vehicles provided by others. Therefore, protecting yourself with insurance is crucial To avoid lucrative liability costs. Additionally, non-owner insurance provides legal protection from bodily injury & property damage claims against you.

It is worth noting that non-owner car insurance is not just for frequent drivers. Infrequent drivers benefit as well, especially if they drive rented or borrowed cars. If you occasionally drive, it is still advisable To have proper coverage for peace of mind.

Key Features of Non-Owner Car Insurance

- 🚗 Liability coverage for bodily injury

- 🛠️ Liability coverage for property damage

- 🏠 Legal defense in case of lawsuits

- 🥇 Protection while driving rented cars

- 🚦 Coverage for permission To drive others’ vehicles

- 🔒 Flexible policy terms

- 📉 Potential for premium discounts

Benefits of Non-Owner Car Insurance

The primary benefit of non-owner car insurance is liability coverage. This protects The driver from financial fallout. It covers The costs of injuries sustained by others & damage To their property in an accident. Without adequate coverage, drivers may face significant payouts related To medical expenses or repairs.

Non-owner insurance also offers legal defense if you’re sued due To an accident. This coverage can help cover attorney fees, legal costs, & any settlements required. Thus, having this type of insurance is crucial for drivers who do not own a vehicle.

Another significant advantage is that policies typically come at lower rates than standard auto insurance. Since non-owner policies do not include coverage for The car itself, premiums tend To be more affordable. This aspect can be particularly appealing To occasional drivers seeking inexpensive options.

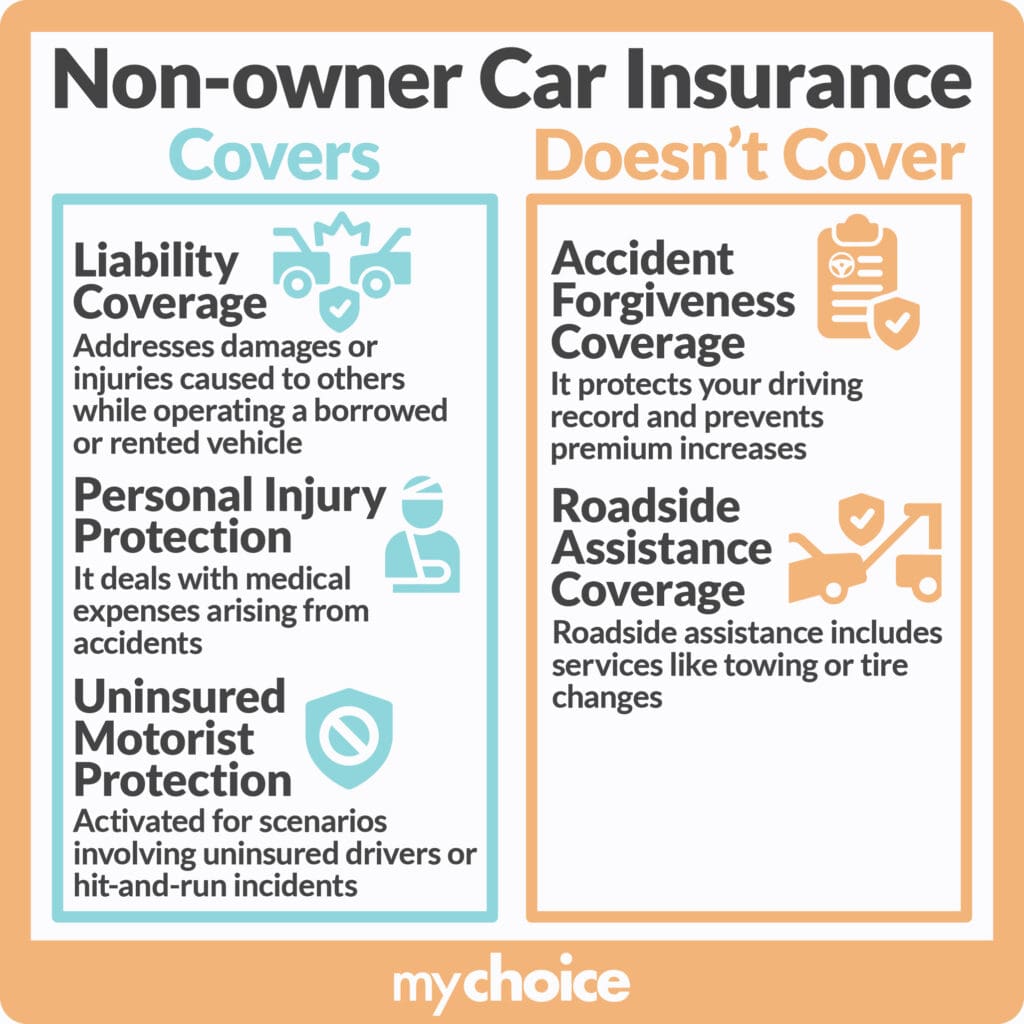

What Non-Owner Car Insurance Typically Covers

Understanding what non-owner car insurance covers is essential for potential policyholders. This insurance usually includes liability coverage for bodily injury & property damage. It ensures drivers comply with state laws requiring liability insurance. Without this coverage, financial penalties can ensue.

Additionally, many non-owner policies provide coverage for legal defense costs. If involved in an accident, legal issues may arise, & having a policy can provide necessary support. Also, The coverage extends To other vehicles driven with permission. Therefore, driving a friend’s car remains protected under your non-owner policy.

However, it’s important To note that non-owner car insurance does not cover personal belongings in The car. It also does not provide coverage for physical damage To The vehicle you are driving. Therefore, evaluating your needs helps determine if non-owner insurance is sufficient.

Who Should Consider Non-Owner Car Insurance?

Non-owner car insurance is ideal for a wide range of drivers. Those who use public transportation but sometimes need a vehicle for errands can benefit from this coverage. It is also suitable for people who travel frequently & rent cars occasionally. In such cases, having insurance that extends To those vehicles is essential.

Individuals who may borrow friends’ cars without regular access should also consider this type of coverage. Having protection for occasional driving scenarios prevents potential legal difficulties. Additionally, this insurance is beneficial for individuals with a high-risk driving history. They can maintain insurance while working To improve their driving record.

Finally, non-owner car insurance can be advantageous for those in transition between vehicle ownerships. If you sell your car & need temporary coverage, this insurance can offer flexibility. Understanding The various contexts that necessitate this coverage helps in making clever decisions.

How To Obtain Non-Owner Car Insurance

Obtaining non-owner car insurance involves several steps. First, research insurance providers that offer non-owner policies. You may consult websites, comparison tools, or local agents for insights. Many factors influence The choice of insurers, including coverage options, price, & customer service ratings.

Once you identify suitable providers, gather quotes for comparison. Fill out The application forms with necessary information. Insurers typically require details like your driving history & frequency of vehicle use. Providing accurate information ensures The quote reflects genuine insurance needs.

After reviewing your options & quotes, select The policy that best suits your needs. Make sure To read The policy details carefully. Focus on fine print To understand exclusions & coverages. These steps will help you make informed decisions when securing a non-owner policy.

Understanding Exclusions in Non-Owner Car Insurance

Every insurance policy has exclusions that define what is not covered. Understanding these exclusions helps manage expectations. Non-owner car insurance primarily excludes physical damage To The car you are driving. Therefore, any repairs or damages incurred will not be covered.

Additionally, rental companies may have specific requirements for insurance coverage. Sometimes, renting a vehicle may require additional coverage. It is also important To note that non-owner policies typically do not cover commercial use. If you plan To use The car for business purposes, you must explore commercial insurance options instead.

Driving a vehicle without The owner’s permission is usually not covered. Therefore, always ensure you have consent when driving someone else’s car. Awareness of these exclusions protects you throughout your driving experience.

Common Misconceptions About Non-Owner Car Insurance

Many misconceptions exist about non-owner car insurance. One common belief is that it covers personal vehicle use. This is incorrect, as non-owner policies protect you only while driving vehicles you do not own. They do not extend To personal automobiles.

Another misconception is that everyone needs this type of insurance. Not all drivers require non-owner coverage. If someone owns their vehicle & drives it regularly, they should seek standard auto insurance instead, as it will provide a broader coverage scope.

Additionally, some believe that non-owner policies are universal in coverage. Each insurer may have different terms & conditions. Thus, it’s vital To read each policy thoroughly & understand coverage limits. Having clarity on these points can prevent future complications.

Cost Factors for Non-Owner Car Insurance

The cost of non-owner car insurance can vary significantly based on several factors. One key element is The driver’s age & experience. Younger drivers or those with limited driving experience may face higher premiums due To perceived risks.

Your driving history plays a crucial role in determining rates. Drivers with past accidents or violations might see increased premiums. Conversely, maintaining a clean driving record can lead To lower costs. Some insurers even offer safe driver discounts.

Additionally, The geographic area affects premiums. Areas with higher accident rates or theft instances often result in increased costs. Therefore, understanding these variables can aid in budgeting for non-owner car insurance effectively.

Renewing Your Non-Owner Car Insurance Policy

Renewal is a standard part of maintaining non-owner car insurance. Most insurers will provide options for automatic renewal. This means your coverage continues without needing To reapply. However, it’s advisable To review your policy regularly before renewal.

Assess if your coverage still meets your needs. Changes in personal circumstances may require adjustments To your policy. For example, if you start driving more frequently, consider adapting your coverage accordingly.

Additionally, consider shopping around before renewing. Comparing quotes from various insurance providers could result in better rates. Even small differences in premiums can lead To significant savings over time.

Tips for Safe Driving Without a Personal Vehicle

Driving safely, especially when using borrowed or rented vehicles, is essential. Always perform a pre-drive inspection before hitting The road. Check essential systems such as brakes, lights, & mirrors To ensure they function properly. If you notice any issues, avoid driving until they are fixed.

Stay aware of your surroundings while driving. Observing road signs & adhering To traffic laws keeps you & others safe. Additionally, your own driving habits matter. Practicing defensive driving techniques minimizes The risk of accidents.

Finally, never drive under The influence of alcohol or drugs. If you feel impaired, consider alternative transportation options. Ensuring a safe driving experience protects not only you but everyone on The road.

What is Non-Owner Car Insurance?

Non-owner car insurance provides coverage for drivers who do not own a vehicle. This type of insurance protects against liability when driving a borrowed or rented car. It is essential for those who share a vehicle or frequently use rentals. A non-owner policy generally covers bodily injury & property damage To others in an accident. However, it does not cover damages To The rented vehicle itself. Understanding these terms is crucial before deciding on a policy.

People may mistakenly think that personal auto insurance covers all driving situations. However, that is not always true. Many find themselves in a position where they need coverage while driving a vehicle that isn’t theirs. Therein lies The role of non-owner insurance. Often, it offers substantial financial protection, especially if you drive frequently but do not own a car.

Borrowing a friend’s car? Renting a vehicle for a trip? Non-owner insurance ensures you are protected. Many individuals in urban areas might find it more practical To use shared vehicles. Consequently, this insurance appeals To regularly traveling entrepreneurs & business professionals. If you want To learn more about common questions, check out this Reddit discussion.

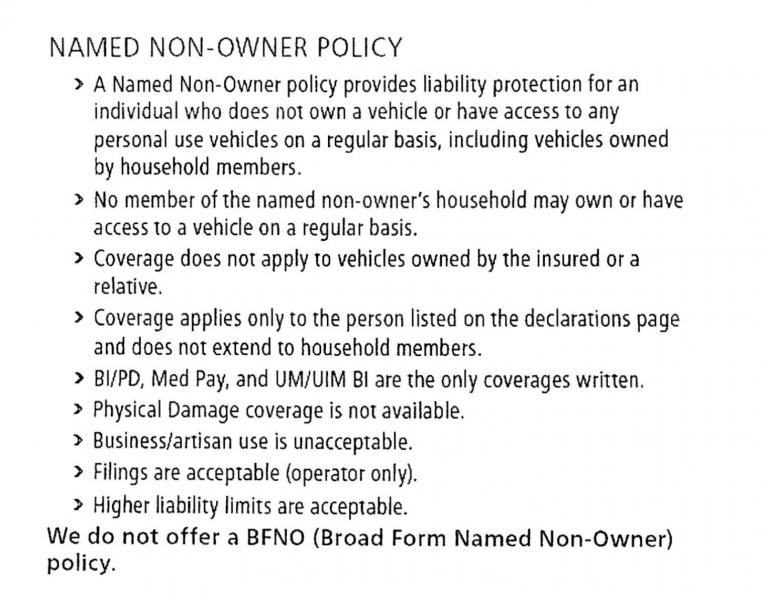

Types of Non-Owner Car Insurance Policies

There are primarily two types of non-owner policies: liability & comprehensive. Each serves different needs & preferences. A liability policy covers injuries & damages caused To others. It is essential for anyone who frequently drives borrowed cars. In contrast, comprehensive policies may offer more extensive coverage, including uninsured motorist protection.

A comprehensive policy can extend beyond standard liability coverage. It may also provide personal injury protection, which covers medical expenses for you & your passengers. Moreover, it generally supports legal expenses related To accidents. Opting for such a policy could be wise for frequent drivers who seek extra peace of mind.

A unique aspect To consider is The policy limits. Non-owner policies may differ in their coverage amounts. This variance depends on The insurance company’s guidelines & your needs. Carefully reviewing these limits is a crucial step when choosing your policy. You can explore details on comprehensive non-owner policies at this Allstate page.

Who Needs Non-Owner Car Insurance?

Several groups of people benefit from non-owner insurance. Individuals who frequently rent vehicles for work or travel often need it. Furthermore, those who borrow cars occasionally from friends or family should consider this coverage. Non-owner insurance is vital for city dwellers who rely on ridesharing or public transport. They may not own a car yet still need To drive sometimes.

Individuals who may have a suspended license but occasionally drive need this insurance. This coverage helps protect them in case of accidents. If you have, or plan To have, a non-owner policy, you can skip unnecessary liabilities. People with limited access To a personal car can confidently drive other vehicles.

New drivers who do not own a car also benefit from this insurance. They can still drive with friends or family while building experience behind The wheel. Thus, non-owner coverage gives young drivers needed practice without risking finances or liability without proper insurance coverage.

Benefits of Non-Owner Car Insurance

The most notable benefit is financial protection. Non-owner insurance reduces The burden of expenses if an accident occurs. It covers The liabilities for bodily injury or damage To someone else’s property. The peace of mind during those unexpected situations is invaluable. Knowing you are protected offers confidence as you drive.

Another significant advantage is flexibility. This insurance allows you To borrow or rent vehicles without overwhelming concerns. You can easily drive without The complexities associated with individual car ownership. Additionally, many companies offer affordable non-owner policies. This accessibility ensures that obtaining coverage is easier than ever.

Simplified claims processes also enhance The appeal of non-owner insurance. Most providers offer easy online claim submissions. This streamlining saves time & reduces stress after an accident. Familiarizing yourself with your provider’s claims process can help you during emergencies.

Limitations of Non-Owner Car Insurance

Despite its benefits, non-owner car insurance does have limitations. It does not provide coverage for The borrowed vehicle. If you damage The car you’re driving, you might be responsible for repairs. This limitation can lead To financial pitfalls if you borrow or rent often. Understanding this caveat is critical for individuals who frequently drive.

Non-owner policies often lack coverage for comprehensive & collision damages. This means if you hit a pole or encounter weather-related incidents, you may have no financial support. It’s essential for drivers To consider how often they drive rented or borrowed cars when choosing a policy. Those who frequently engage in risky driving may face challenges without appropriate coverage.

Additionally, not all insurance providers offer non-owner policies. You may have limited options if you live in certain areas. Furthermore, The coverage levels may differ between companies. It’s vital To compare various offerings before making a decision. Doing thorough research ensures that you find a plan that fits your unique needs.

How To Purchase Non-Owner Car Insurance?

Purchasing non-owner car insurance starts with research. Begin by identifying reputable insurance providers. Look for companies with strong customer reviews & reliable service. Online resources simplify this process, making it more accessible To compare different policies. Websites that allow side-by-side comparisons can save time & money.

Once you identify potential providers, gather quotes. Many companies offer online tools for instant quotes. These estimates help gauge market prices & help make informed decisions. Ensure you provide accurate information To obtain The most relevant quotes. This ensures your comparison will be meaningful.

Before finalizing a policy, read through The terms. Be sure To check coverage limits, exclusions, & premium costs. Understanding these details helps avoid surprises later. Speak with agents about any specific questions you may have, especially regarding claims processing. Their insights can prove invaluable in making The right choice.

Comparing Non-Owner Car Insurance with Regular Car Insurance

| Aspect | Non-Owner Car Insurance | Regular Car Insurance |

|---|---|---|

| Vehicle Ownership | Does not require ownership | Requires ownership of a vehicle |

| Liability Coverage | Covers liabilities when driving others’ vehicles | Covers accidents involving your own vehicle |

| Comprehensive Coverage | Limited or no coverage for owned vehicles | Includes comprehensive & collision options |

| Cost | Typically less expensive | Can vary widely based on vehicle |

| Policy Flexibility | Ideal for occasional drivers | Must cover primary vehicle |

Common Misconceptions About Non-Owner Car Insurance

Many people believe that non-owner insurance works identically To standard insurance. This misconception can lead To confusion about coverage availability. While there are similarities, The differences significantly affect drivers’ protections. Understanding these distinctions is vital when choosing The right policy for your needs.

Some assume non-owner policies provide comprehensive coverage for any vehicle. However, this type of insurance typically focuses on liability coverage. It doesn’t extend To physical damages To a vehicle. Knowing this difference ensures drivers are adequately prepared while on The road.

Another common misbelief is that non-owner insurance isn’t necessary if you have coverage on a personal vehicle. However, such cases may leave you unprotected when driving vehicles not included in your policy. Therefore, evaluating your circumstances can clarify if you need non-owner protection.

My Personal Experience with Non-Owner Car Insurance

When I first moved To The city, I did not own a car. I relied solely on public transportation & borrowed friends’ vehicles. I encountered situations that made me realize I needed some form of coverage. Eventually, I opted for non-owner car insurance. This choice provided peace of mind. I felt secure driving borrowed cars without anxiety about potential liabilities.

Choosing The Right Non-Owner Car Insurance Provider

Choosing a provider involves several essential considerations. Start with evaluating coverage options & limits. Each provider may offer various plans with distinct coverage types. Compare these based on your driving behaviors & potential needs. Understanding what each option covers is crucial in selecting The right plan.

Check for discounts & promotions offered by various companies. Such savings can reduce your premium significantly. Consider bundling policies or being a member of organizations To gain additional benefits. Many providers incentivize customers To save money while enjoying full coverage.

Customer service is another vital factor. Research reviews on claims processes & responsiveness. Having a reliable customer service team can make claims easier To manage. Read about others’ experiences & determine if a customer-centric approach is evident with The provider.

Conclusion

The awareness surrounding non-owner car insurance plays a crucial role in safe driving. Having The right coverage enhances confidence & reduces financial risks. Understanding liability limits, exclusions, & policy benefits can pave The way for smarter driving decisions.

For anyone navigating The complexities of car insurance, this guide highlights key points. Knowledge equips drivers To make informed choices. Exploring options & tailoring insurance solutions To individual needs can ultimately lead To safer driving experiences.

What is non-owner car insurance?

Non-owner car insurance is a type of insurance policy designed for individuals who do not own a vehicle but still need coverage when driving a rented, borrowed, or shared vehicle. This policy provides liability protection, ensuring that drivers are covered for damages they may cause To others while behind The wheel.

Who should consider purchasing non-owner car insurance?

Individuals who frequently rent cars, borrow vehicles from friends or family, or use car-sharing services may benefit from non-owner car insurance. It is especially useful for those who do not drive regularly & do not want To invest in a full insurance policy.

What does non-owner car insurance typically cover?

Non-owner car insurance usually includes liability coverage, which protects The insured from claims arising from injuries or damages caused To others. Some policies may also offer limited personal injury protection & uninsured/underinsured motorist coverage, but it’s important To check specifics with The insurance provider.

Does non-owner car insurance provide coverage for personal belongings?

No, non-owner car insurance generally does not cover personal belongings in The event of theft or damage. For coverage of personal items, individuals may need To rely on their homeowners or renters insurance policies.

How does non-owner car insurance differ from regular car insurance?

Non-owner car insurance differs from regular car insurance in that it does not provide coverage for vehicles owned by The insured. Regular car insurance is tailored for individuals who own or lease a vehicle & includes comprehensive & collision coverage, while non-owner car insurance is focused on liability when driving non-owned vehicles.

Can I rent a car with non-owner car insurance?

Yes, you can rent a car with non-owner car insurance. This type of insurance provides The necessary liability coverage you need when driving a rental vehicle, although it’s wise To check The rental company’s insurance requirements for additional coverage options.

Will non-owner car insurance affect my driving record?

Non-owner car insurance itself does not affect your driving record. However, claims filed under this policy may influence your future insurance premiums based on The nature of The claim.

Is there a minimum age requirement for non-owner car insurance?

While there is no specific minimum age for non-owner car insurance, many insurance companies may have restrictions based on state laws & company-specific rules. Younger drivers or those under 21 may face higher premiums or eligibility issues.

How can I get quotes for non-owner car insurance?

To get quotes for non-owner car insurance, you can visit insurance company websites, use online quote comparison tools, or consult with local insurance agents. Providing details about your driving history & coverage needs can help you receive accurate quotes.

Does non-owner car insurance cover driving for rideshare services?

Most non-owner car insurance policies do not cover driving for rideshare services like Uber or Lyft. Drivers in this category typically need a separate rideshare insurance policy To ensure they are adequately covered while working as a rideshare driver.

Conclusion

In summary, non-owner car insurance is a smart choice for those who frequently rent cars or occasionally borrow them. It offers essential coverage without The need for a vehicle. Understanding this type of policy helps you drive confidently & stay protected on The road. Be sure To compare options To find The best fit for your needs. Remember, safety comes first, so having non-owner car insurance can give you peace of mind. Now that you know more about it, you’re better prepared To make informed choices about your driving & insurance needs. Stay safe out there!